Executive Summary – Why DeRosa Capital 20?

Imagine owning a cash-flowing Hilton hotel, without lifting a finger.

That’s the opportunity with DeRosa Capital 20—a stabilized, Hilton-branded Home2 Suites located next to Houston’s George Bush Intercontinental Airport. This offering provides investors access to:

✅ Daily-pricing revenue flexibility

✅ Built-in loyalty demand through Hilton Honors

✅ Immediate cash flow with long-term upside

✅ Strong exit optionality to REITs, institutional buyers, and 1031 investors

DeRosa Capital 20 was secured off-market, priced well below replacement cost, and underwritten with conservative assumptions. With regional bank financing, experienced operators in place, and a clear 5-year hold strategy, this is the kind of deal that checks all the boxes: brand strength, stable income, recession resilience, and upside potential.

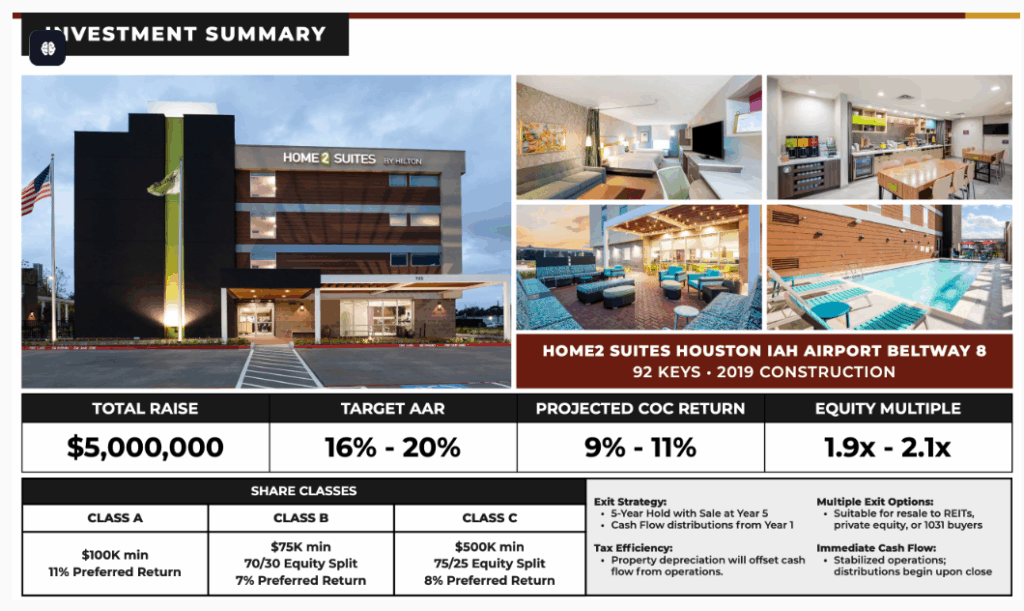

Investment Summary

This offering is a $11.0M stabilized Hilton-branded asset: a Home2 Suites by Hilton (2019 Build, 92 Keys) located adjacent to Houston’s George Bush Intercontinental Airport. This is not a distressed or repositioning play—it’s cash-flowing from day one, with upside through operational improvement and revenue optimization.

DeRosa is targeting a $5.0M equity raise, with projected 16–20% AAR, 9–11% Cash on Cash, and a 1.9x–2.1x equity multiple over a 5-year hold.

Located in one of Houston’s busiest hospitality corridors, the asset benefits from airport, corporate, event, and medical traffic—creating stable occupancy and brand-driven pricing power in all market cycles.

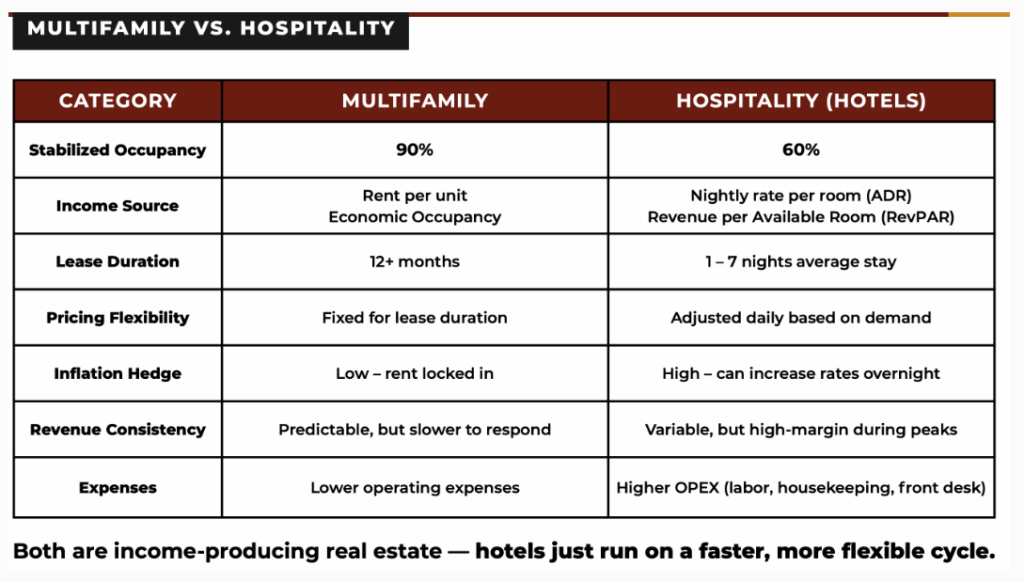

Why Hotels?

The hotel sector is undergoing a transformation. Post-pandemic recovery, combined with inflation-driven ADR growth and travel rebounds, is driving performance. We’re targeting cash-flowing hotels in strong secondary markets, where we can enhance value without major repositioning, and benefit from operating leverage, professional management, and branded loyalty programs.

Hotels offer a unique blend of real estate and operational business, allowing for daily repricing, margin optimization, and rapid response to market demand. Unlike traditional apartments, hospitality assets can generate outsized returns through smarter operations, better branding, and focused management. In a post-COVID world, travel is booming—and we’re positioned to benefit.

Why Hilton?

Hilton is not just a name—it’s a competitive edge. These hotels benefit from Hilton’s built-in booking engine, loyalty programs, operational support, and brand-driven pricing power. This translates to higher RevPAR, increased occupancy, and a broader buyer pool upon exit—all critical to protecting and growing investor capital.

Why REA Capital Management & The DeRosa Group?

At REA Capital Management in partnership with the DeRosa Group, we’ve been helping investors build wealth through real estate since 2018. With over $175 million in assets under management, $30 million in investor distributions, and an average 22% IRR on deals that have gone full cycle, our track record speaks for itself.

What sets us apart is our commitment to transparency, alignment, and execution. We don’t just structure great deals—we manage them with care. Every asset we acquire has been underwritten conservatively, capitalized thoughtfully, and selected with our investors’ long-term outcomes in mind.

DeRosa Capital 20 is our first hotel fund, but we’re not going it alone. To ensure operational excellence from day one, we’re partnering with proven Hilton hotel operators—teams with deep experience running brand-aligned, performance-driven hotels across the country.

Our Partners

Hospitality is an operationally intensive asset class—and we embrace that. Instead of learning as we go, we’re bringing in professionals who already know how to maximize revenue, control expenses, and deliver top-tier guest experiences.

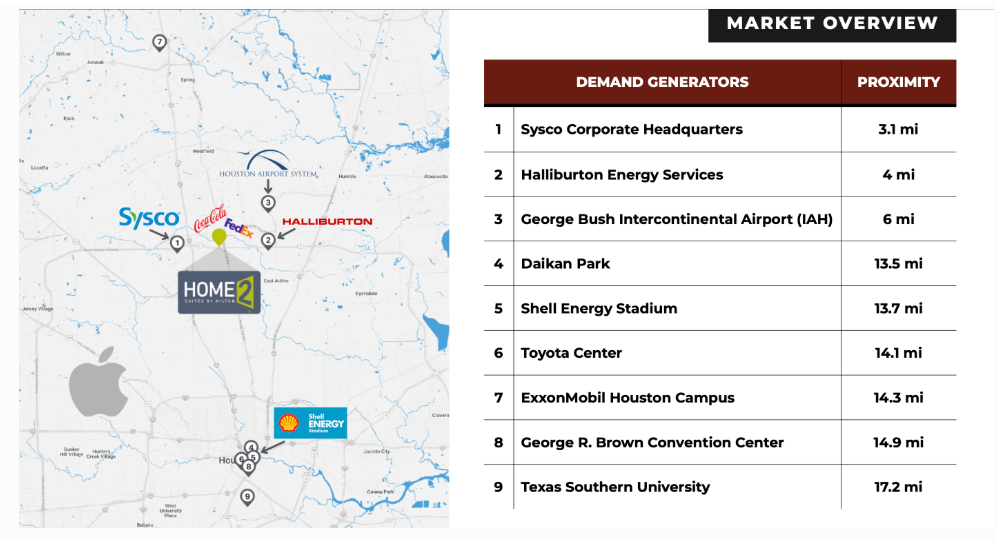

Why Houston?

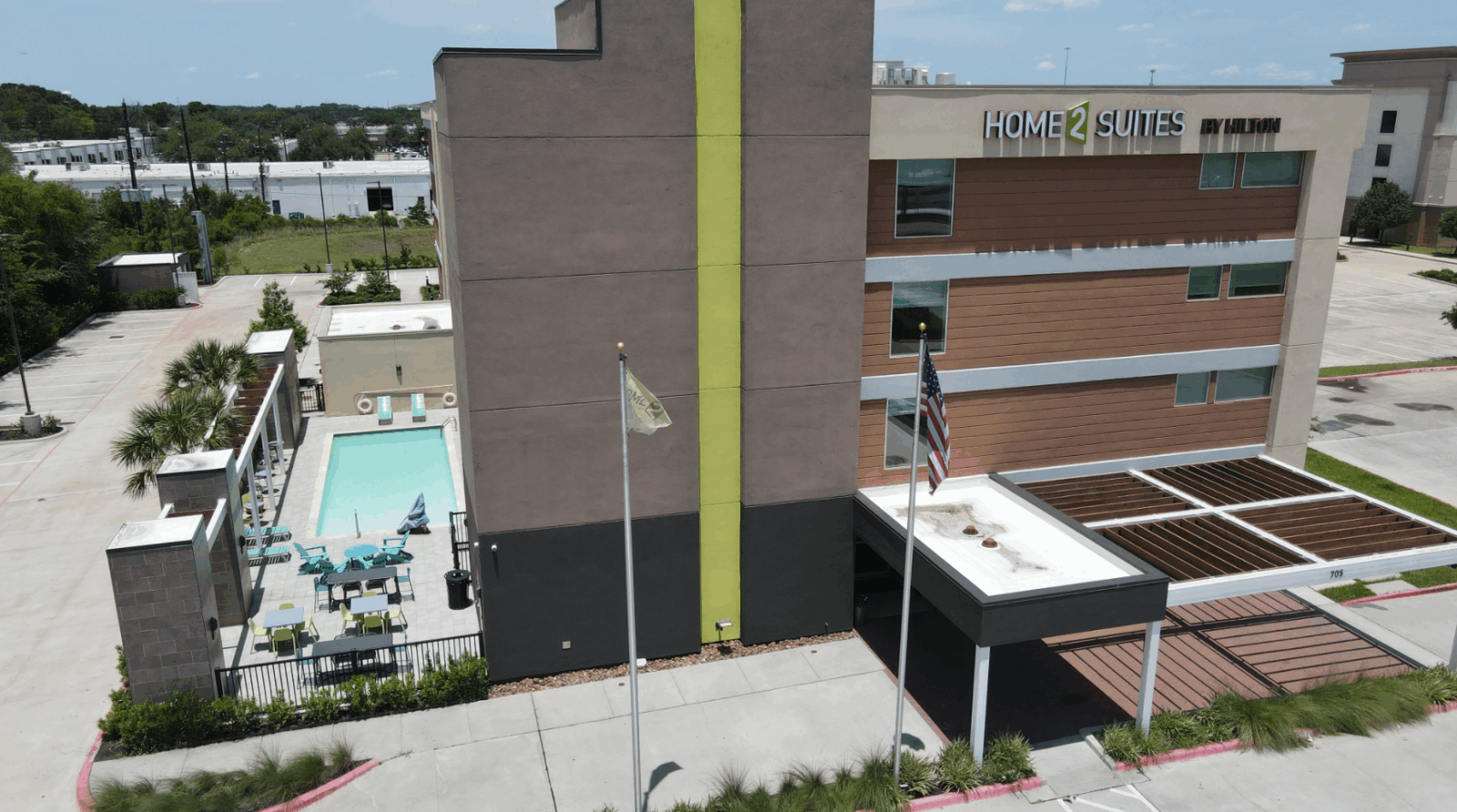

Houston is a global energy hub with a diverse and resilient economy. The Home2 Suites is located directly adjacent to George Bush Intercontinental Airport (IAH)—a top 5 U.S. airport by passenger volume—making it a prime location for extended-stay demand, business travel, medical tourism, and airline-related contracts. The asset is positioned to capture stable, recurring demand from Fortune 500 employers, events, and international transit—all contributing to strong occupancy and pricing power year-round.

What’s the Strategy?

This Hilton-branded Home2 Suites is a stabilized, cash-flowing asset with immediate income in place. Our business plan focuses on light value-add through Hilton-mandated PIP improvements, revenue optimization, and proactive asset management. We’re bringing in Hilton-experienced operators to drive higher ADR and occupancy while maintaining lean operating expenses.

We’re targeting a 5-year hold with consistent cash flow throughout. Given the branding, location, and asset profile, we anticipate a broad buyer pool at exit—including REITs, institutional investors, 1031 buyers, and private operators—providing multiple paths to liquidity and upside.

Market Deep-Dive: Houston

Houston is one of the most economically resilient and business-friendly cities in the U.S., making it an ideal market for cash-flowing hospitality.

🛫 Strategic Airport Proximity

Located minutes from George Bush Intercontinental Airport (IAH), Home2 Suites captures consistent demand from over 40 million annual travelers—especially business and extended-stay guests.

⚡ Corporate & Energy Hub

Home to 21 Fortune 500 companies, Houston generates year-round travel demand from oil & gas, aerospace, logistics, and healthcare—creating durable occupancy and rate strength.

📍 Undersupplied Submarket

Situated in the North Beltway/Greenspoint area, the hotel serves a growing need for branded, extended-stay accommodations—ideal for contractors, consultants, and flight crews.

📈 Operational Upside

Purchased off-market and well below replacement cost, the asset will benefit from improved revenue management under a Hilton-aligned operator and continued ADR growth.

🛡️ Resilient Economics

Houston’s diversified economy, low taxes, and strong population growth have made it a top-performing real estate market through multiple cycles.

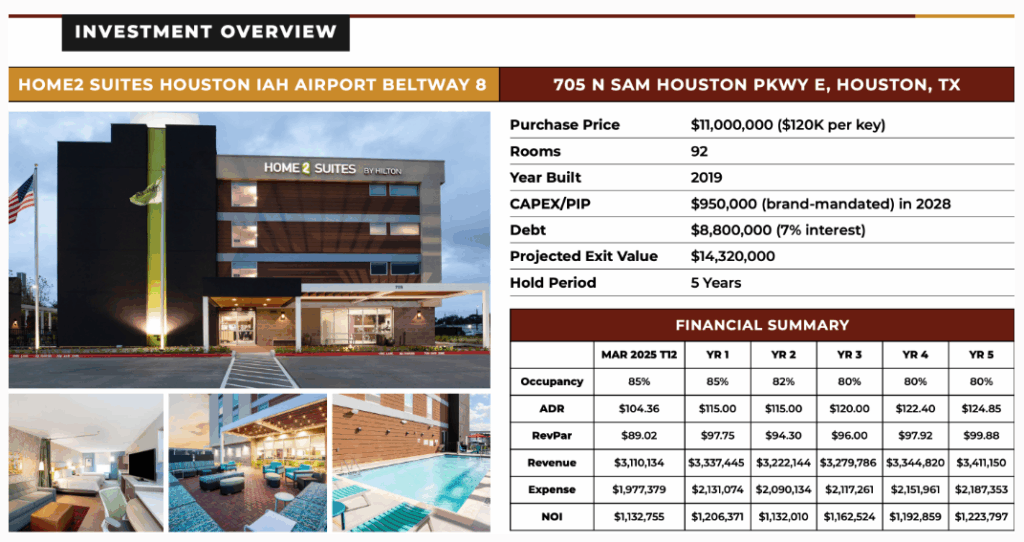

🏨 Home2 Suites Houston IAH – Property Overview

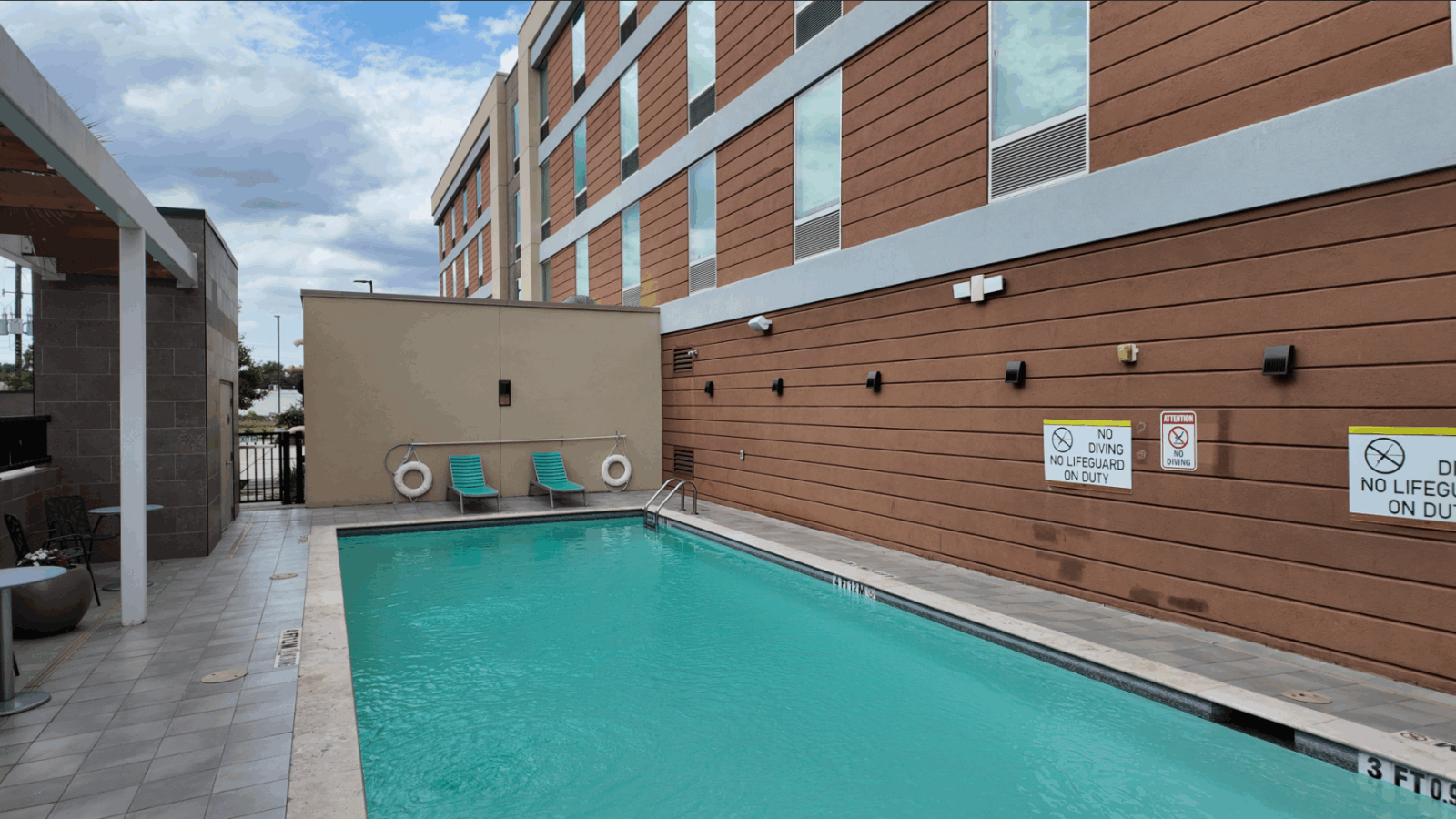

This 92-key, Hilton-branded Home2 Suites was built in 2019 and sits just minutes from George Bush Intercontinental Airport (IAH)—one of the busiest travel hubs in the U.S. With consistent 80%+ occupancy and a growing ADR, this asset is already cash-flowing and positioned for sustained performance.

We’re acquiring the property off-market at just $120K per key, well below today’s $180K–$200K+ replacement cost. Backed by Hilton Honors loyalty and located in a high-demand corporate corridor, the hotel serves business travelers, flight crews, and extended-stay guests with spacious suites and essential amenities.

Key highlights:

-

Stabilized with 85% occupancy and $3.1M+ annual revenue

-

Built-in growth via ADR optimization (projected to rise from $104 to $125 over 5 years)

-

$950K PIP reserved for 2028 ensures continued brand compliance

-

Strong buyer appeal due to brand, condition, and location

-

Projected 5-year NOI growth with consistent margin performance

With conservative debt (7% interest) and long-term demand from corporate travel and airport traffic, this asset combines institutional quality with operational upside—making it a cornerstone of the DeRosa Capital 20 portfolio.

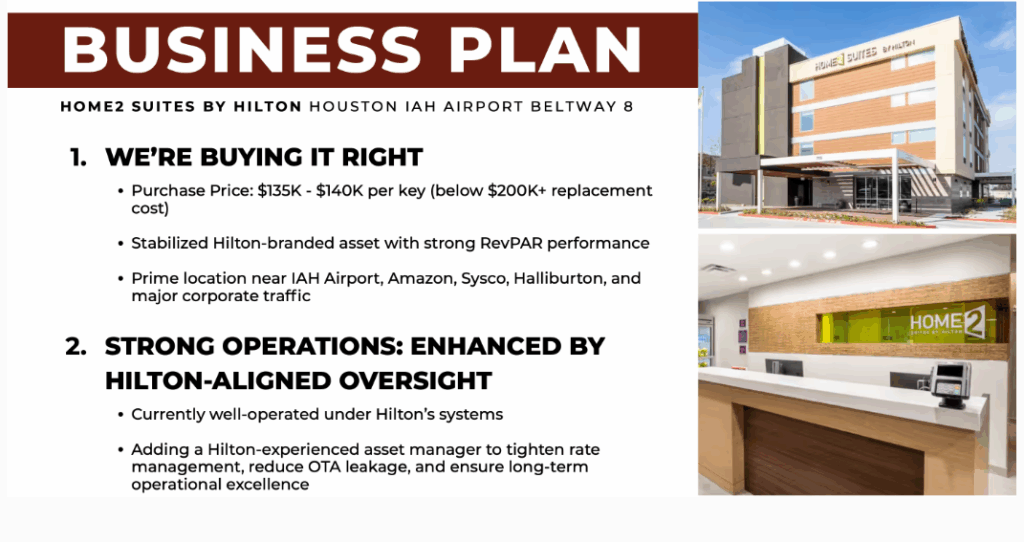

Business Plan – Home2 Suites

We’re acquiring this 2019-built, Hilton-branded asset for just $135K–$140K per key (after PIP/Capex), significantly below the $200K+ replacement cost. Located near IAH Airport and major employers like Amazon and Halliburton, it’s already stabilized with strong RevPAR.

Operations will be further enhanced by a Hilton-aligned asset manager focused on tightening rate strategy, boosting direct bookings, and driving long-term efficiency—without disrupting cash flow.

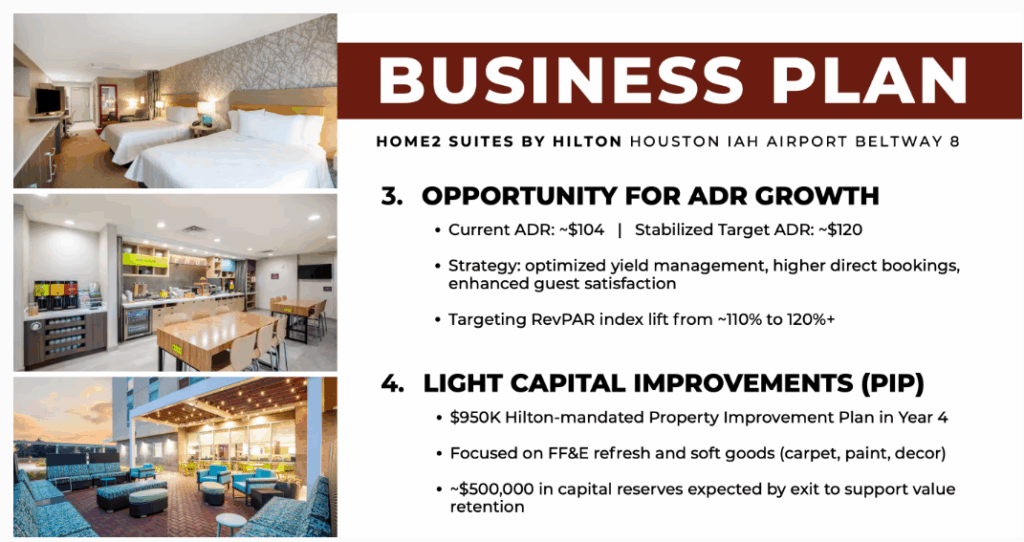

We’re targeting ADR growth from ~$104 to $120+, driven by smarter revenue management and improved guest satisfaction—lifting RevPAR index from ~110% to 120%+.

A $950K PIP is scheduled for Year 4 and fully underwritten, with reserves in place. This light refresh (FF&E, soft goods) ensures brand compliance and strong positioning at exit. Minimal capex, meaningful upside.

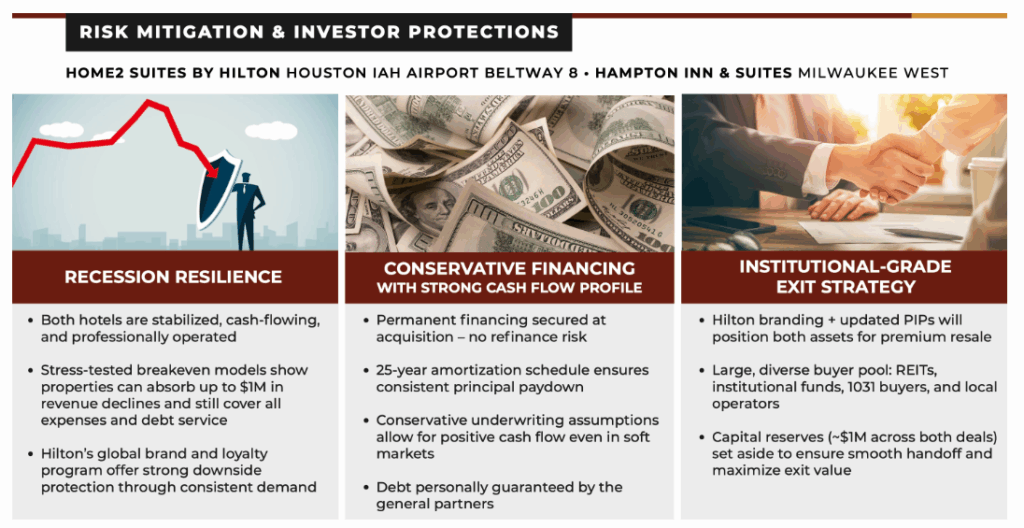

Risk Mitigations

DeRosa Capital 20 is structured to protect investor capital in any market cycle.

The Home2 Suites is a stabilized, cash-flowing asset, professionally managed and underwritten with a conservative, downside-tested model. The property can withstand a $1M+ annual revenue drop and still breakeven. We’ve secured permanent fixed-rate financing with no refinance risk, and structured the debt with a 25-year amortization schedule for steady principal paydown and long-term stability.

At exit, Hilton branding, completed PIP improvements, and strong market fundamentals position the asset for broad appeal—from REITs to 1031 buyers—while over $600K in reserves provides a smooth operational handoff and enhances resale value.