Empowering Passive Investors To Achieve:

Generational Wealth, Capital Appreciation, Cash Flow, Tax Savings

… for serious investors only, please.

Who are we?

REA Capital Management is a Princeton NJ based private equity firm empowering high-net-worth investors to build Passive Income and Equity appreciation through low-risk real estate investments. Our exclusive partnerships with premier operators in select high growth markets enables us to provide best in class opportunities for Tax Advantaged Cash Flow and Equity Growth.

Our Strategy: Enable you to invest in top-tier real estate opportunities easily, in multiple locations and asset classes without the hassle of traditional landlord responsibilities.

What We Do

About REA Capital Management

REA Capital Management in partnership with the DeRosa Group has been investing in commercial real estate assets since 2018 with $170M in Assets Under Management, 2,000+ Total Units Under Management, $70M Amount of Equity Raised, 700+ Active Investors. With an average 13%-16% IRR, 2.3x-2.8x Equity Multiple, Avg 10%-12% Cash on Cash.

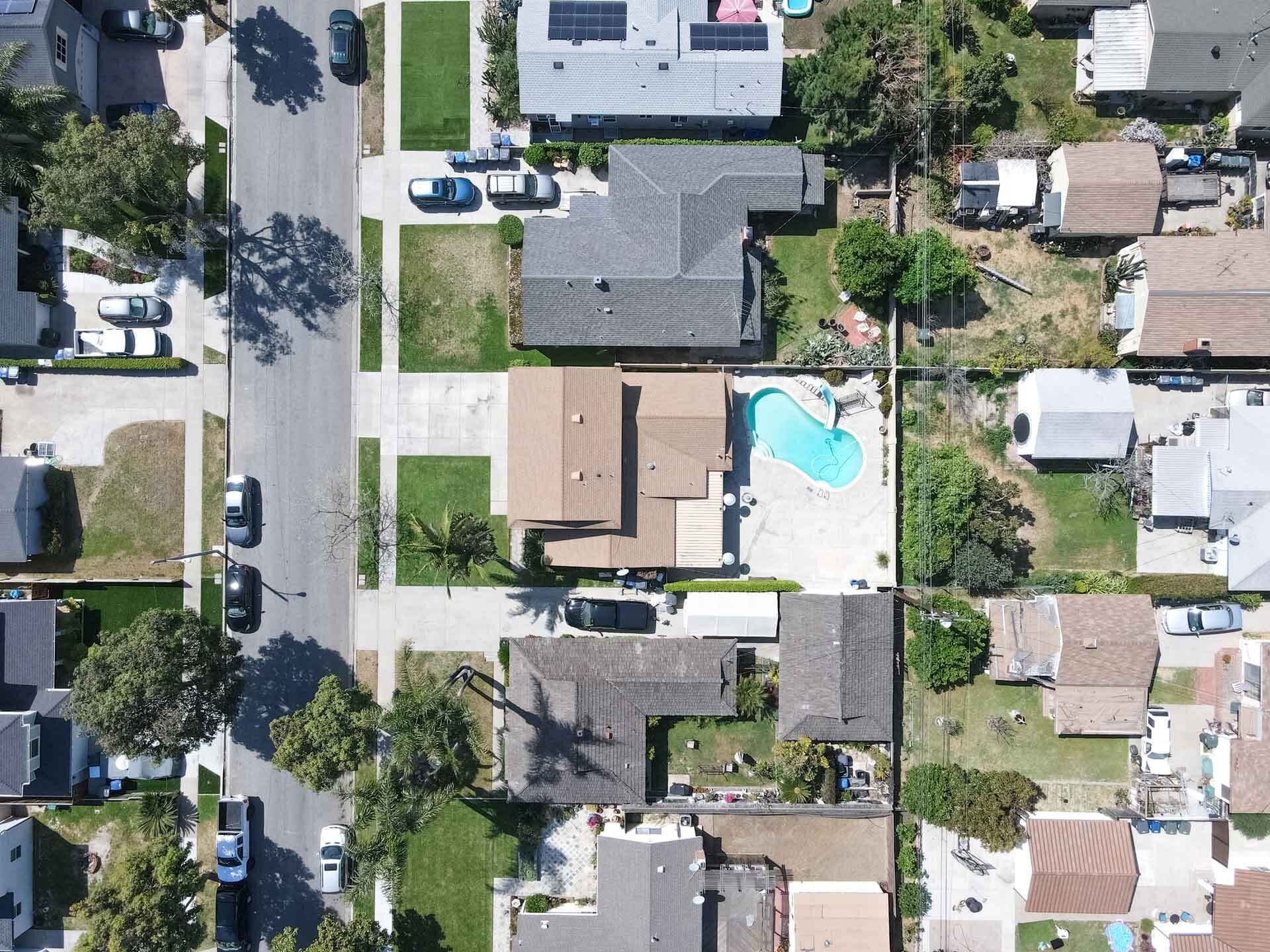

We focus on the human side of real estate, securing wealth building opportunities for investors and creating safe, family oriented neighborhoods that our residents are happy to call home.

Be Knowledgable

Join Our Exclusive Group

See if you qualify and Join the exclusive REA Capital investor group to be the first notified when we have new accredited offerings open for investment.

Why Choose Us? -> Proven Stats

A Team You Can Trust

With over Twenty years of experience in independent real estate investing, coupled with our expertise in lending and finance, REA Capital Management offers unsurpassed advisory and management services for your assets. Our corporate culture is based on an unwavering dedication to trust and integrity, and these business principles are applied every time we engage with clients.

What We Do For You

Take a moment to review our process for acquiring and maintaining our quality multifamily, and hotel investments.

Investment Approach

One of our guiding values at REA Capital Management is to provide investors with full transparency in every aspect of their portfolios. REA clients are always reassured by our disciplined, data-driven approach. Our due diligence in finding solid investment opportunities helps us identify income-producing, tax-efficient real estate opportunities on a deal-by-deal basis. We often serve as the mortar between the bricks in connecting real estate investors with top investment opportunities.

Get Immediate Access To Our eBook

“Passive Real Estate Investing: 101”

Join Our Exclusive Group of Investors

Get In The Preferred Investors Group. >>

Access the button below to fill out the form if you are interested in investing in one of our upcoming opportunities. We would be happy to schedule a call with you to discuss your investment goals.

NOTE: We are only accepting accredited investors at this time. We do accept international investors. Please click here to learn more.

Immediately after applying, you will be enrolled in our “Get To Know Us” campaign, where you learn about us, and continue to learn about Investing in Private Equity Real Estate Syndications.